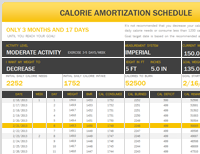

Knowing Amortisation

The scheduling of the mortgage loan with a detailed payment table which states how the payments will be calculated periodically. The need to pay off debt on time and there has to be regular pay off which will include the interest too. The calculation is done on the basis of the principal against the percentage of interest which makes up for the amortization schedule. This scheduling will help the borrower to know the portion of the payment made to pay off the debt which is used in the interest payment and the remaining portion for the premium from the principal after the payment is made each time. Find out more on amortization calculator with extra payments .

Types of amortization methods

There are different types of amortization methods employed to get them tabular form

- There is linear amortization

- The declining balance amortization

- Annuity amortization

- All at once amortization

- Large end payment amortization

- There is also negative amortization

It has to be noted that amortisation is always focused on chronological manner. This is based on the origination date of the when the loan was taken. It has to be noted by the borrower will have to make the last payment of the loan installment will differ from the ones previously paid. This table of amortization will help break down the whole